Renters Insurance in and around Johnson City

Johnson City renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Johnson City, TN

- Elizabethton, TN

- Jonesborough, TN

- Greeneville, TN

- Bristol, TN

- Telford, TN

- Washington County

- Carter County

- Sullivan County

- Roan Mountain, TN

- Erwin, TN

- Tri Cities

- Kingsport, TN

- Limestone, TN

- East TN

- Gray, TN

- Bluff City, TN

- Hampton, TN

- Blountville, TN

- Unicoi, TN

- Lamar, TN

- Chuckey, TN

- Fall Branch, TN

- Church Hill, TN

There’s No Place Like Home

The place you call home is the cornerstone for everything you hold dear. It’s where you build a life with your favorite people. Home is truly where your heart is. That’s why, even if you live in a rented property or condo, you should have renters insurance—especially if you own items that would be difficult to fix or replace. It's coverage for the things you do own, like your bed and guitar... even your security blanket. You'll get that with renters insurance from State Farm. Agent Steve Sonneberger can roll out the welcome mat with the dedication and wisdom to help you protect yourself from the unexpected. Skilled care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Johnson City renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

State Farm Has Options For Your Renters Insurance Needs

Many renters don't realize that their landlord's insurance only covers the structure. Your valuables in your rented space include a wide variety of things like your set of favorite books, bicycle, cooking set, and more. That's why renters insurance can be such a good move. But don't worry, State Farm agent Steve Sonneberger has the experience and personal attention needed to help you choose the right policy and help you keep your things safe.

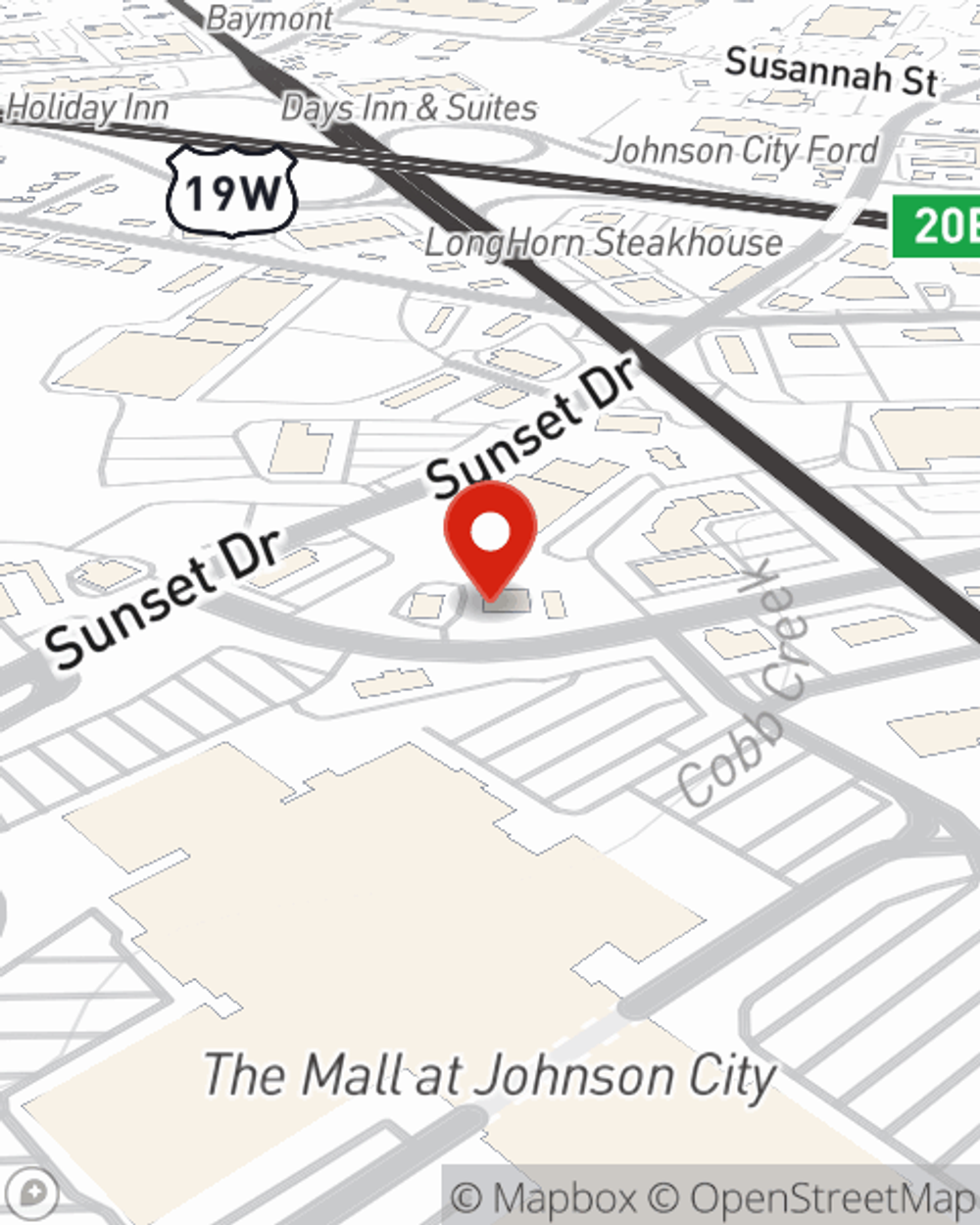

A good next step when renting a apartment in Johnson City, TN is to make sure that you're properly insured. That's why you should consider renters coverage options from State Farm! Call or go online today and learn more about how State Farm agent Steve Sonneberger can help meet your renters insurance needs.

Have More Questions About Renters Insurance?

Call Steve at (423) 283-9121 or visit our FAQ page.

Simple Insights®

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Steve Sonneberger

State Farm® Insurance AgentSimple Insights®

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.